We all want to know how the experts do it.

We want to know how athletes work out, how CEOs structure their days, and how successful traders approach the market. In this blog, we’re exploring five “secrets” only successful investors know. As you’ll soon see, there’s one shared ingredient amongst successful traders: they’re patient.

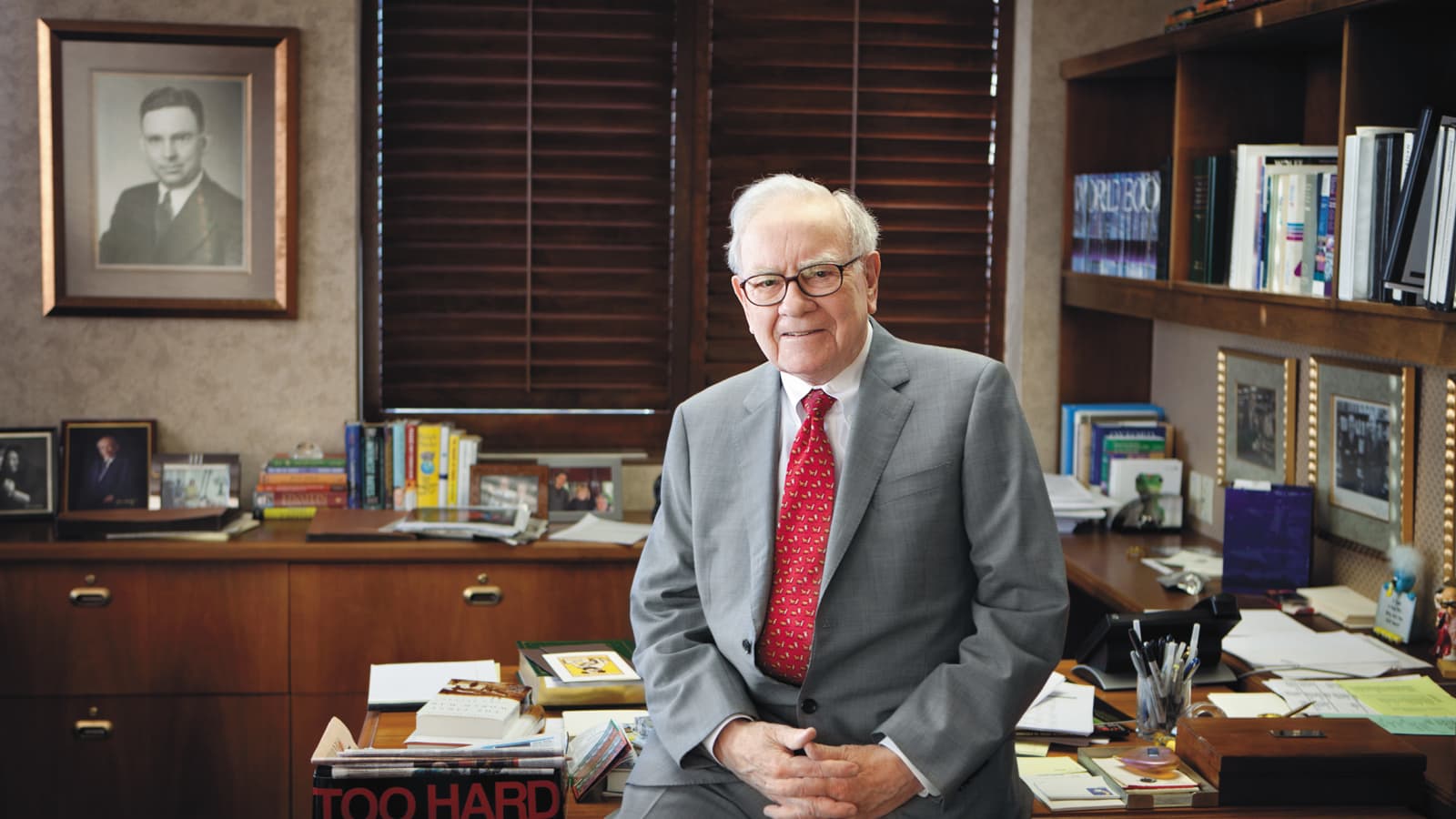

Indeed, as Warren Buffett once put it, “The stock market is a device for transferring money from the impatient to the patient.”

Note: the following “secrets” do not constitute official investment advice and are instead commonly-held observations about the market. For specific advice on individual stocks, be sure to contact a financial advisor.

1. Don’t Catch The Falling Knife

You’ve had your eye on a stock for months.

You’ve set your entry point, and you’ve been waiting for the moment to jump in. Finally, out of the blue, the stock starts to fall. Before long, it’s plummeting. So you wait. And then you wait some more.

It drops past your entry point with seemingly no end in sight, leaving you with one thought: “if I time this right, I’ll win big.” You’re trying to catch “the falling knife.” Needless to say, if you reach out your hand at the wrong moment, you’ll be in a world of hurt. Indeed, the odds that you’ll be right are utterly dwarfed by the odds that you’ll be wrong.

Often, attempts to catch “the falling knife” are the result of an emotional, knee-jerk response. You may get lucky, but such traits typically run counter to successful investing.

Veteran investors know better than to merely trust their intuition. According to Daniel Kahneman, author of Thinking, Fast and Slow, “Intuition cannot be trusted in the absence of stable regularities in the environment.”

In other words, don’t always trust your instincts — especially when your heart rate is jacked.

2. Stocks Take the Stairs Up…

What goes up must come down. The laws of gravity also apply to the stock market. As the old saying goes, “Markets take the stairs going up and the elevator going down.” In other words, investing is seldom smooth sailing, and like a rogue wave, a bull market can quickly turn bearish.

Recent history affirms this. For example, the bull market that began in early 2009 and ended in early 2020 was the longest on record. Thanks to the pandemic, the S&P 500 dropped 35% in a matter of weeks. Indeed stocks tend to drop far faster than they rise. People are fearful of loss, and the group psychology that initiates sell offs can spread like wildfire.

During periods of volatility, it’s vitally important to ignore the uproar and remain disciplined. Successful investors know that volatility isn’t something to be feared. It’s something to be embraced.

In confusion, there is profit. After all, just six months following the COVID-19 plunge, the S&P 500 closed at a record high in August 2020, over 50% above its low in March. Again, it pays to be patient.

3. Smart Traders Review Their Trades

While history is a great teacher, it’s a cruel disciplinarian. Indeed, those who fail to learn from it are often doomed to repeat it. Wise investors are willing to review their own trading history. They’re brave enough to swallow their pride and look back objectively on their decisions.

Make no mistake, the profit and loss statement can be deceiving. After all, “good” trades can lose money while “bad” ones can turn a profit. Dedicated investors will keep trading journals where they set their targets and log their records. By doing so, they can look back on their habits and assess how well they adhered to their plan. Ultimately, smart investors know they’re an army of one. They understand that there’s no one looking out for them but themselves.

That’s why they don’t hesitate to review their trades and hold themselves accountable. Even when it’s humbling.

4. Good Trading is Boring

If you’re overly excited during a trade, one of two things is likely true:

- You’re going to lose money

- You’re going to make a lot of money in a short time frame, get brash, and then make a bad decision in the near future.

Pride comes before a fall. Now does this mean you shouldn’t enjoy trading? Not at all. And is it okay to believe in what you’re doing and be enthusiastic about it? Absolutely. But here’s the thing: smart and strategic trading is way less glamorous than the movies, Instagram, and CNBC make it out to be.

The people screaming buy, buy, buy and sell, sell, sell aren’t exactly the best guides to follow in your investment journey. In reality, you need to set your own investing ground rules, establish your entry and exit points, conduct careful research and ongoing analyses, and stick to your plan.

A good defense wins football games. Good trading is boring.

5. There Are No Secrets

The world is replete with so-called financial “experts.” After all, there’s a seemingly limitless supply of them sounding off on TV, podcasts, and newspapers. In reality, many of these experts simply made one accurate prediction and subsequently built an entire career on it.

Even a broken clock is right twice a day. This is not meant to denigrate the “experts,” but instead, it’s a reminder that nobody has all the answers. No one has perfect information. And no one knows what the future may bring.

Even Warren Buffett, one of the world’s most lauded financial minds, freely admits to his human fallibility. In fact, he believes one of his biggest mistakes actually cost Berkshire Hathaway over $200 billion. When it comes to investing, the biggest secret is that there are no secrets.

There’s only patience, strategy, and yes, the wheel of fortune. And while luck seemingly plays a role in the market, technology can harness data in real time to help investors make smart decisions when it counts.

RiskAlert™ is the modern trader’s best friend. By monitoring your investments 24/7/365, RiskAlert™ will immediately contact you when your investments fall below your established risk tolerance percentage.

These alerts don’t come hours, days, or weeks after the fact.

Instead, RiskAlert™ reaches you in real time — so you can decide to buy, sell, or hold when it matters most. And because RiskAlert™ is a totally independent monitoring tool, you can use it with any trading platform or money manager. Invest with confidence, and reap rewards with RiskAlert™.

Click here to learn more!

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, investment or accounting advice. You should consult your own tax, legal, investment and accounting advisors before engaging in any transaction.